36+ Lump sum mortgage payment calculator

How much mortgage can I. See all savings guides.

2

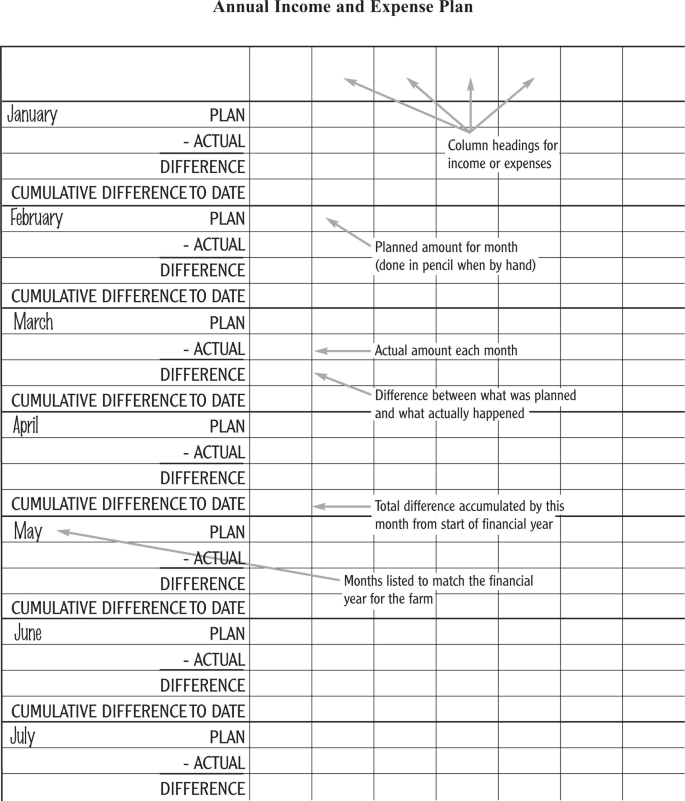

By increasing the monthly payment you pay off your mortgage faster and cut down on interest payments.

. So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Thats about two-thirds of what you borrowed in interest.

A borrower can make a one-time lump sum payment or increase his monthly payment. See all ISA guides. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

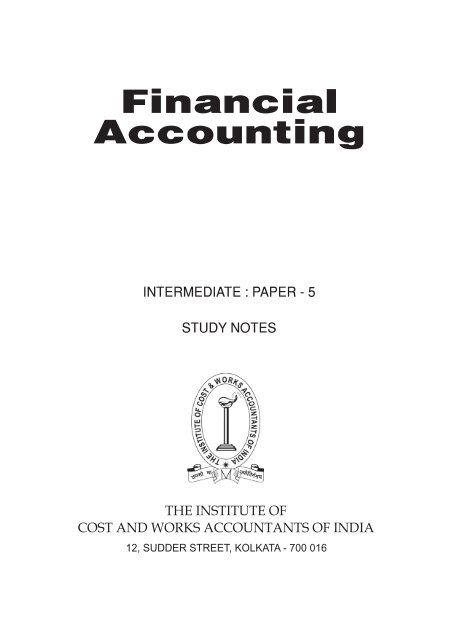

How Much Do They Cost. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. It is a comparison of the average advertised Big 6 bank special offer rate versus.

If your balance at the end of the year is 100000 the maximum lump sum payment for that year would be 20000. Extra payments until youve paid off the loan. Current rate range is 549 to 1599 APR.

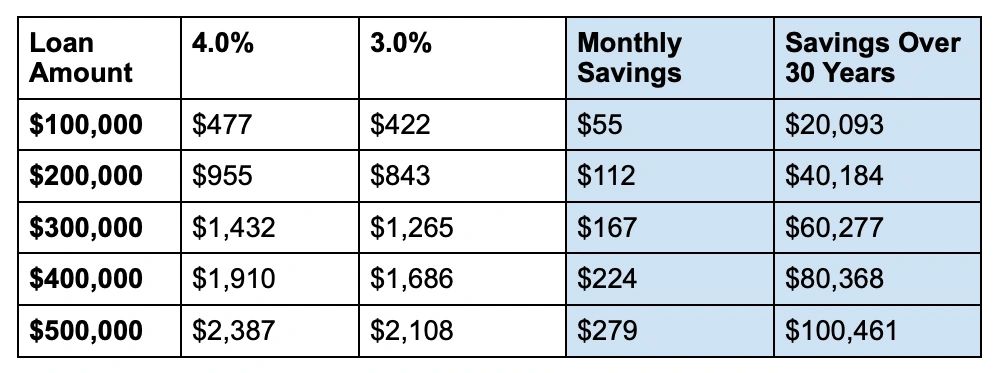

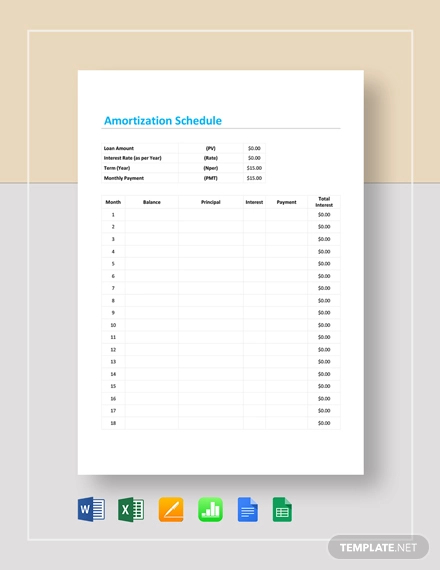

This amortization schedule will let you know what making extra payments will save you for your circumstances. Lump sum investment calculator. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. The down payment requirement jumps to 10 with a credit score of 500 to 579. 1 the average discounted discretionary rate at the Big 6 banks as tracked by Butler Mortgage 2 the average broker rate as tracked by MortgageDashboardca and 3 the lowest conventional full-featured 5-year fixed rate at Butler Mortgage as of March 14 2017.

On the calculator I cleared before I started didn. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000.

Mortgage Calculator with Lump Sums. Multiply your monthly income by 28 or 36 and then divide it by 100. Our advanced mortgage payment.

All or part of the homes equity is sold upfront at a discount with the person receiving. 1 Your loan terms including APR may differ based on amount term length and your credit profile. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

One lump-sum extra payment. Extra payments at a different frequency and on different dates than the normal payment. Points cost 1 of the balance of the loan.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

This would mean that if a lender has a max LTV of 80 a borrower could borrow up to an additional 25 of the value of the home 50000 via either a home equity loan or a home equity line of credit. 2021 at 636 pm Karl What am I doing wrong. How much of a lump sum payment you can make without penalty depends on the original mortgage principal amount.

To the 2836 rule which says to not spend more than 28 of your gross monthly income on housing expenses and only 36 of your income on overall monthly recurring debt. What Are Current Mortgage Rates. Lenders typically require a down payment of at least 20.

The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. Mortgage calculator with extra payments lump-sum or multiple extra payments. If your home is worth 200000 and your first mortgage has a balance of 110000 then the amount due on that mortgage is 55 of the homes value.

Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan. Adjust down payment interest insurance and more to start budgeting for your new home. Estimate your monthly payment with our free mortgage calculator and apply today.

Excellent credit is required to qualify for lowest rates. FHA borrowers are required to pay two types of FHA mortgage. Monthly mortgage payment Your monthly mortgage payment has four components.

Discount points are a way of pre-paying interest on a mortgage. Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance. The Ultimate Mortgage Calculator calculates mortgage payment amount term down payment or interest rate creates payment plan with dates points and more.

Your total interest on a 250000 mortgage. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. A specific number of extra payments.

Find out how much you could borrow on a mortgage using our calculator. Loans lines of credit and credit cards are subject to credit approval. Savings is over five years.

FHA loans require a 35 down payment with a 580 or higher credit score and funds can come from employers close friends family members or charitable organizations. The payment schedule supports. You can make extra payments regularly or a lump-sum payment toward the mortgage principal to reach that 20 sooner.

You pre-pay a lump sum of money and then obtain a lower interest rate for the duration of the loan.

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

Zerarwwmasbtjm

2

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Front Page Accounting Cdr N

Mortgage Rates Have Never Been Lower

Amortization Schedule 10 Examples Format Sample Examples

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

2

2

Generating Lasting Wealth Springerlink

Amortization Schedule 10 Examples Format Sample Examples

2

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Lendingtree Interactive Mortgage Rate Calculator Banner Ad Lendingtree Banner Ads How To Apply